Take a look at any summary, review or outlook for the European M&A market and you see the same story: a substantial drop in activity and values, but also a palpable anticipation of rapid improvement. In its summary of the 2023 market, legal and tax firm CMS christened it ‘Boom and Gloom’, citing 73% of deal makers that expect the level of European M&A activity to increase over the next 12 months, compared to just 53% last year.

The report claims that whilst almost all companies interviewed are currently considering M&A, the biggest buy-side driver is expected to be the availability of undervalued deal targets, and the sell-side it is expected to be led by ‘distressed’ situations.

However, 87% of deal makers expect financing to be tighter compared with 2021 – this includes 45% who expect it to be ‘much harder’.

So it is clear that whilst there is a return to improved market conditions around the corner, those conditions are not going to be anything like five years ago.

Which begs the immediate question, how can those teams on both buy and sell sides, best prepare for an upswing? What can they do now, to make the most of an improved tomorrow?

Our take on this is – perhaps unsurprisingly – focused on the operations and technology within those companies: in a digital and data-driven world, it will be those companies that embrace and exploit technology the best, that are first off of the starting blocks in the race to a returned market buoyancy.

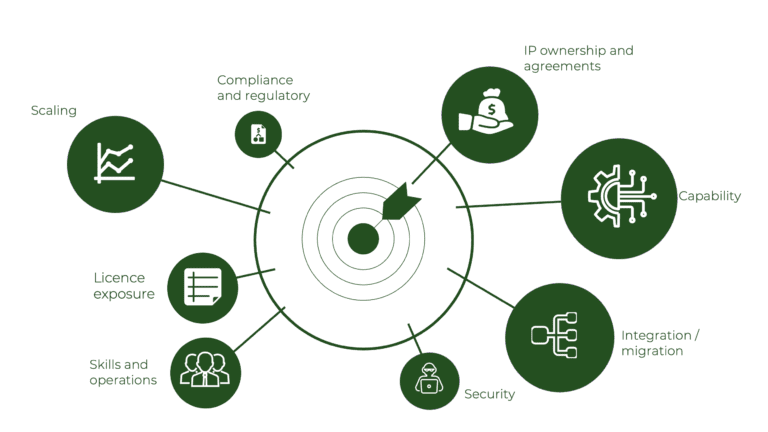

Which means preparation needs to account for that technology – in short, conducting the necessary due diligence on all aspects of business impacted or driven by technology.

Our experience is that this digital due diligence is far more impactful than businesses think it will be: in a data driven world, modern business is digital and once you assess the technology underpinning operations, or start looking for excess licensing, or even scrutinising if the technology is up to scratch in order to achieve the business objectives of a transaction, you can soon shift the grounds of the merger, acquisition or divestment.

Which means right now is the best time to make sure none of these nasty surprises lay in store for your transaction, once activity returns, or indeed to seize the opportunity on the buy side to acquire for less… a little preparation will go a long way.

If you want to see the real state of the tech that drives your business, or one that you are thinking of buying, get in touch….