It is often easy to be wowed by valuations: huge numbers, reported as almost certainties amidst the pressured world of buying and selling entire businesses.

And the numbers are huge – ARM recently attracted numbers of around $70bn. This figure was backed up by Softbank buying a 25% stake, via its Vision Fund, with the numbers equating to a valuation of $64bn. In the words of John Le Carré: ‘That is wrath of God money…’

But the truth is that these numbers are far from set in stone. Indeed, in the case of ARM, the valuation has been slashed to $50-$54bn – at its worst, nearly a 22% drop. The point is that for a business once called ‘the best tech company to come out of the UK this century’, there are still factors that can have a big impact on valuation.

So, imagine what that volatility is like in other companies.

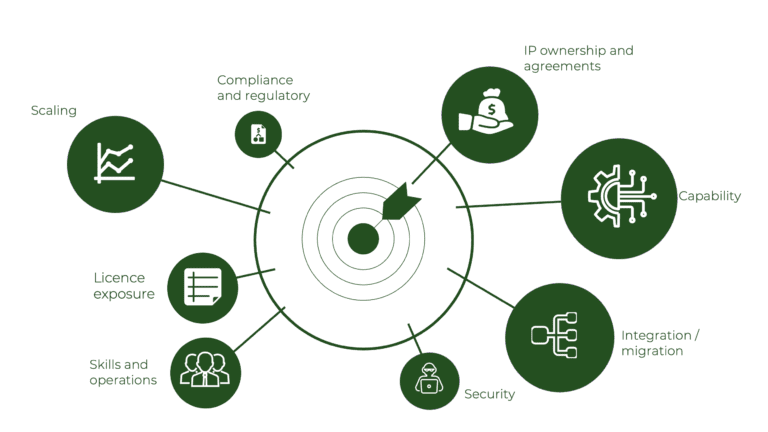

Whilst we have not seen it wipe $10bn from a valuation, our experience is that technology can be one of the major factors in shifting a valuation. Our digital due diligence has revealed exposure to £500,000 excess software licensing, and even led to terminated transactions when it was realised that the technology would not enable the realisation of business objectives.

If you are looking to sell, that can be a nasty shock because suddenly, you are selling an asset for a lot less than you hoped. And if you are looking to buy, the time and effort spent finding these factors that shift the valuation of a company is critical.

It is visibility that takes the sting out of the volatility – insight into the technology that underpins a modern business. To find out how BML Ventures could deliver that visibility, get in touch…